Leader in fund management for clean energy and sustainable infrastructure in Latin America.

We combine financial strategy and sustainable vision to transform investment into progress. With more than a decade of experience, we are dedicated to catalyzing change for a better future, investing in cutting-edge technologies and projects that define the new era of infrastructure.

Our Projects

We focus our expertise on creating and managing a diversified portfolio that meets market needs and current environmental and social imperatives.

Sustainability

Ennova América considers ESG (Environmental, Social, and Governance) issues as essential pillars, integrating these criteria into all our processes, management, and operations to maximize benefits while promoting sustainability and positive social impact.

What We Do

We are dedicated to developing, managing, and acquiring key assets in infrastructure and energy sectors such as transportation, mobility, water, and renewable energies. Our goal is to generate high returns for our investors while supporting sustainable development and modernizing critical infrastructure in the regions where we operate.

About Us

Ennova America is a private equity firm founded in 2013, dedicated to driving the transition towards clean energy and sustainable infrastructure across Latin America. With over a decade of experience, we focus on developing, managing, and acquiring key assets in transportation, mobility, water, and renewable energy sectors.

Our goal is to deliver strong financial returns while fostering environmental sustainability, economic growth, and social development in the communities we serve.

We integrate Environmental, Social, and Governance (ESG) principles across all our investment processes and operations to maximize value while promoting sustainability and positive social impact.

Business Model

Sustainability

We invest in infrastructure and clean energy projects that support a sustainable transition while generating a positive social impact.

Portfolio

Our investment strategy includes both the development of Greenfield projects and the acquisition and optimization of Brownfield assets.

Active Involvement

We take an active role in the projects we invest in, ensuring long-term value creation and operational excellence.

Our Funds

A private equity fund launched in 2018, focused on developing, operating, and managing clean energy investments.

A fund focused on solar photovoltaic projects, set to operate starting in 2024, with a projected investment of $500 million.

In partnership with Grupo Indi, we’ve structured a Fibra E with an initial capitalization of approximately $2 billion pesos.

Solutions

Investments

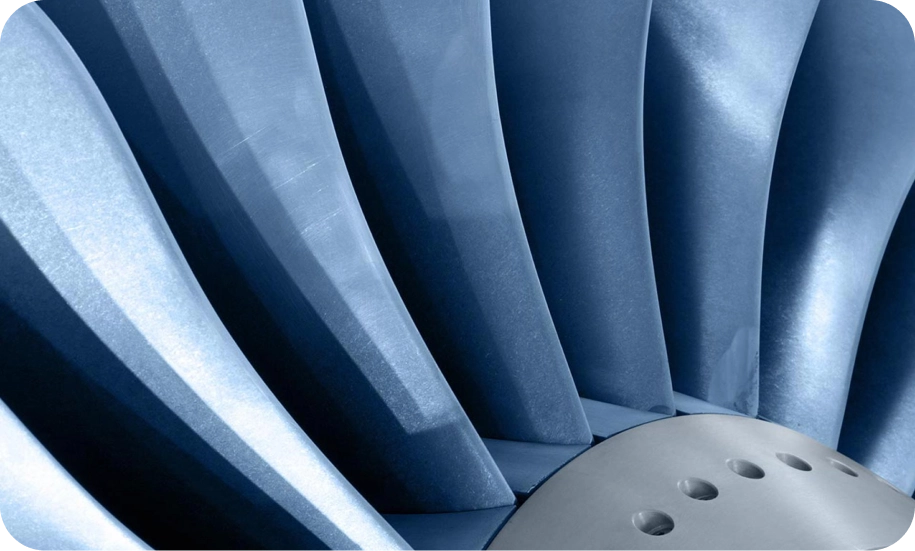

Energy

Infrastructure

What We Offer?

Experience and knowledge

We have a highly skilled team with over 20 years of experience in finance, energy, and infrastructure, ensuring we exceed investor expectations for performance and sustainability.

Diversification

We provide a diversified portfolio of infrastructure and energy projects across various sectors and regions, reducing risk and maximizing returns.

Transparency and Accountability

We commit to full transparency throughout the investment process, with regular performance updates.

Positive impact

We contribute to the economic and social development of the country, driving sustainable solutions through ESG initiatives.

Profitability

We continually strive to deliver superior returns, targeting double-digit internal rates of return.

Environmental, Social, and Governance (ESG) Principles

We aim to achieve the highest level of sustainability across all aspects of our organization, carefully considering the impact of our operations on the communities and ecosystems where we work.

Our strategy focuses on a circular approach to understanding the comprehensive needs of our stakeholders and material issues.

We distinguish ourselves through strong, independent, and transparent corporate governance, supporting our investors in achieving their ESG objectives.

Contact

Address

Prado Sur No. 274, Lomas de Chapultepec, Mexico City, Mexico, 11000

E-mail address

info@ennovaamerica.com

Telephone number

+52 (55) 4744 4813